- FDA Approval Tees Up T-DXd Plus Pertuzumab as a New SOC in HER2+ Breast Cancer OncLive

- EMA validates Type II Variation MAA for AstraZeneca, Daiichi’s Enhertu TipRanks

- ENHERTU® Plus Pertuzumab Type II Variation Application Validated in the EU as First-Line Treatment of Patients with HER2 Positive Metastatic Breast Cancer Yahoo Finance

- T-DXd/Pertuzumab Earns Type II Application Validation in EU for HER2+ mBC CancerNetwork

- Enhertu plus pertuzumab Type II Variation application validated by EMA The Pharma Letter

Category: 3. Business

-

FDA Approval Tees Up T-DXd Plus Pertuzumab as a New SOC in HER2+ Breast Cancer – OncLive

-

Business index starts year with ‘little momentum’

Sentiment across major German businesses held steady at 87.6 points, according to the January edition of the monthly Ifo index.

Some analysts had predicted a slight rebound in the Munich-based foundation’s survey of around 9,000 business leaders but the overall figure was ultimately unchanged.

“Assessments of the current situation edged up somewhat, while expectations were revised slightly downward,” Ifo Institute President Clemens Fuest said. “The German economy is starting the new year with little momentum.”

Germany’s economy has been struggling in recent years, with only marginal GDP growth of 0.2% in 2025, according to provisional figures, and similarly marginal negative growth figures in the two previous years. Chancellor Friedrich Merz flagged improving the situation as a key goal for 2026 in his New Year’s speech.

Sharp increase in struggling manufacturing sector, services slip

Ifo’s Fuest reported that the index increased “sharply” in the particularly hard-hit manufacturing sector.

“Companies assessed current business conditions as more positive. Their expectations were also notably less pessimistic,” he said. “However, capacity utilization fell from 78.1 to 77.5%, remaining below the long-term average of 83.2%.”

Meanwhile, the institute found a deteriorating climate in the services sector, both in terms of the curent situation and the perceived outlook. Ifo also said that the “climate also cooled noticeably in tourism.”

The trade- and construction-specific indices also rose. Both retail and wholesale trade rebounded but “remain well below their long-term averages,” according to Fuest.

Germany’s central bank estimates that the slow pace of growth will continue in the first quarter of 2026, with economists forecasting 1% growth for the year as whole.

Edited by: Wesley Dockery

Continue Reading

-

What’s next for new rules on power supply emissions

Corporations, trade groups and other stakeholders have until Jan. 31 to comment on the Greenhouse Gas Protocol’s controversial proposed changes to the methodology for calculating emissions related to electricity.

The deadline was originally Dec. 19, but the organization extended the public consultation period to accommodate more feedback.

The revisions, which would take effect in 2027, suggest major changes to how companies will be able to claim emissions reductions related to virtual power purchase agreements and other contracts they use to match their electricity consumption with renewable electricity sources.

This is the first major refresh since the methodology was adopted in 2014.

New math

Under the proposed update, corporations will be required to match those loads on an hourly basis using renewable resources on the same grid as their original power consumption. These calculations fall under the Scope 2 category for greenhouse gas emissions.

“This is intended to reduce double counting and ensure reported clean energy purchases more accurately reflect the physical realities of the power grid,” Greenhouse Gas (GHG) Protocol said in October, when it opened the public consultation.

The organization may include exemptions for smaller organizations. It is also considering a clause that would exempt legacy contracts signed before the new rules take effect. It’s particularly interested in comments related to those items.

GHG Protocol is also soliciting comments about a methodology that covers “consequential” accounting methods that guide how companies can report on projects that add renewable power to electric grids that are fossil fuel-heavy but aren’t in the same location as their operations.

Some companies with active renewable energy goals invest in projects of this nature, such as Salesforce and Microsoft, mainly for their social benefits and community goodwill.

More complexity

Corporate energy buyers expect the proposed modifications to complicate the process of making Scope 2 reduction claims.

“From my perspective, everything needs to be evaluated through one specific lens, and that is, Are the rules successfully encouraging more clean energy on the grid to most effectively tackle climate change?” said Bob Redlinger, director of energy and global sustainability at Apple, during a recent webinar discussing the changes. “And from that lens, the current rules have been very successful. I think that’s the lens from which any new rules or proposed changes also need to be examined.”

Contracts by companies with emissions reduction commitments have added (or will add when complete) close to 128 gigawatts of renewable or clean energy to the U.S. electric grid from 2014 through November 2025, according to data collected by the Clean Energy Buyers Association, which takes issue with the hourly matching proposal.

While some regions of the U.S. grid have abundant clean energy resources, many other places do not.

The new rules could have the unintended impact of making it not economical and overly complex for some companies to continue making voluntary renewable energy purchases, Redlinger said: “I worry that with the GHG Protocol’s proposal to seek hourly matching for individual organizations and with very narrow geographic boundaries, it could actually slow the progress of decarbonization.”

What’s next

After the public consultation closes, GHG Protocol will analyze the comments and produce a summary. The organization’s governance rules suggest that this analysis may be published on its website, along with specific feedback — although some companies requested a chance to comment anonymously.

After the review period, the technical working group and independent standards board responsible for the methodology will consider modifications.

Another draft of the updated rules will be published in 2026, followed by another 60-day public consultation period. A final version of the revised methodology is due in 2027.

Continue Reading

-

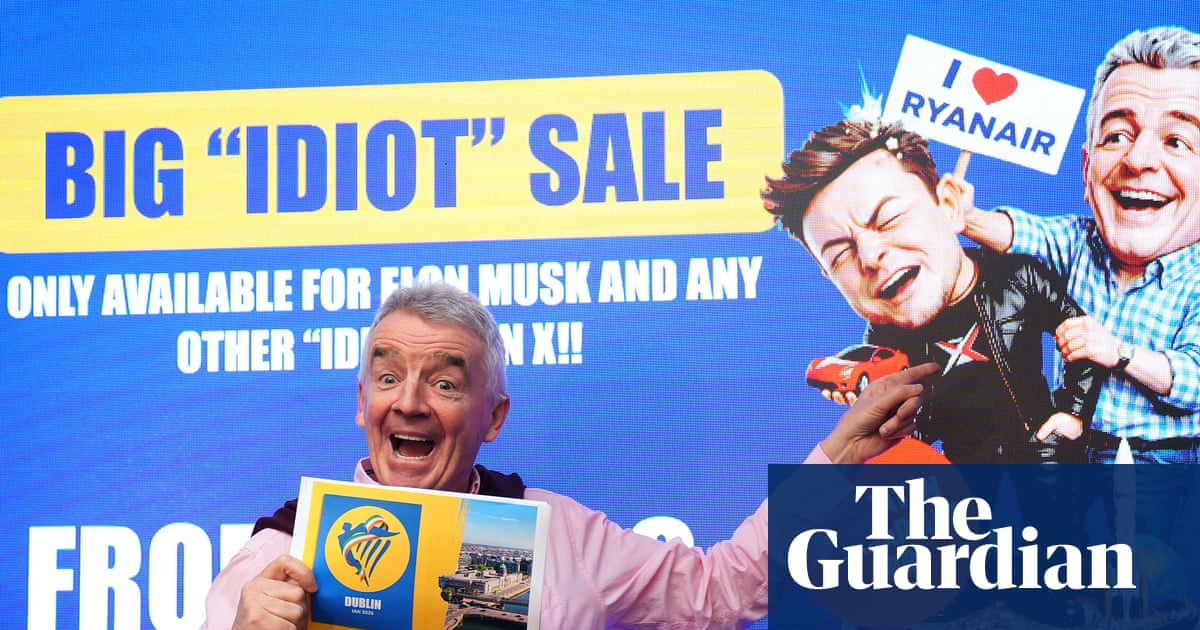

Ryanair says it could use Starlink in future despite Elon Musk feud | Ryanair

Ryanair would be open to using Elon Musk’s Starlink wifi on its planes in the future, its finance chief has suggested, amid a feud between the boss of the Irish airline and the world’s richest person.

The airline would look at “whoever is the best, when the tech and price is right” for in-flight wifi, the Ryanair chief financial officer, Neil Sorahan, said.

Sorahan was speaking after an online spat between Ryanair boss Michael O’Leary and Musk, after O’Leary was asked whether he would follow Lufthansa and British Airways in installing Starlink satellite internet technology on his fleet of 650 aircraft.

The chief executive rejected the idea, saying that adding antennas to the jets would result in a “2% fuel drag”, adding an extra $200-250m to its $5bn (£3.66bn) annual kerosene bill.

Musk said the interpretation was “misinformed” in a post on his X platform, triggering a tit-for-tat exchange of insults, with each man calling the other an “idiot”.

Sorahan said the spat was “good fun” and had brought more people to the Ryanair website. O’Leary said last week that his quarrel with Musk had increased bookings by between 2% and 3%, after the company pushed a “big idiot sale” campaign poking fun at the Tesla chief executive, estimated to be worth $788bn by Forbes.

However, Sorahan added that in-flight wifi was still a long way away for Ryanair. “I have been looking at wifi for as long as I have been at Ryanair,” said the executive, who joined the airline in 2003. “There is still a fuel cost that we would have to absorb.”

There are concerns passengers may be less willing to pay for wifi on Ryanair’s short-haul flights, which typically only take between one and three hours.

The airline, which has grown to become the biggest in Europe, raised its forecasts for passenger numbers, profit growth and fares on Monday. It now expects to carry 216 million passengers by March 2027, and said average fares this year would rise by 7% to 8%, compared with previous guidance of 7%. Average fares rose 4% to €44 (£38) in its third quarter to the end of December.

Its profit after tax fell 22% to €115m in the third quarter, excluding a provision of €85m for a fine from the Italian competition authority, which the company said it was appealing against. However, it expects profit after tax between €2.13bn and €2.23bn for its full year.

The airline said Boeing deliveries were progressing well compared with a year ago when the aircraft supplier struggled to deliver jets on time. It said the final four Max 8 models would be delivered by the end of February, while the newer Max 10 would join the Ryanair fleet in spring 2027.

Shares in Ryanair, which are listed in Dublin and New York, dropped 1.7% in early European trading on Monday. They rose by more than 50% over the course of last year.

Continue Reading

-

Property cat reinsurance softening to continue into April, June and July renewals, says Fitch

With property catastrophe reinsurance rates significantly softening at the January 2026 renewals, rating agency Fitch forecasts that further softening will continue into the April, June, and July renewals later this year.

At the same time, the agency confirmed that it is maintaining its ‘deteriorating’ sector outlook for global reinsurance in 2026, citing moderately weaker operating and business conditions expected over the year.Fitch adjusted its outlook for the global reinsurance industry to “deteriorating” from “neutral” back in September, with the agency saying at the time that “Softer pricing conditions and rising claims costs will pressure underwriting margins, though profitability remains strong by historical standards.”

Analysts at Fitch recently highlighted how record amounts of reinsurance capital supply from both traditional and alternative sources exceeded the slight demand increase from buyers during the January 1, 2026 renewals, which drove a softening market, but one that analysts feel can still deliver profits.

“Property catastrophe pricing significantly softened at the January 2026 reinsurance renewals following rate reductions at the mid-year 2025 renewals, with reductions in risk-adjusted prices across most lines,” Fitch said.

Rate reductions of up to 5% were observed for US and European catastrophe-exposed portfolios, while for loss-free US property business, pricing declines reached as much as 20%, compared with a range of down 10% to up 10% from the previous year.

Additionally, European property rates also fell by up to 20% for loss-free accounts at the January renewals, versus a range of down 15% to up 5% in 2025.

As mentioned, the rating agency expects to see these softening conditions continue throughout 2026.

“We anticipate softening market conditions to continue at the midyear 2026 renewals in April (Asia-focused) and June/July (Florida). Abundant capacity and rising competition are likely to lead to gradual price erosion across most reinsurance lines and looser policy terms in property lines, barring large loss activity,” Fitch explained.

Fitch also outlined that competitive behaviour remains rational and disciplined, with loss ratios continuing to benefit from favourable claims frequency trends.

Moreover, while severe hurricane-related events and other natural catastrophe losses remain a key source of volatility for P&C insurers, Fitch Ratings believes the sector is well capitalised to withstand large single-event losses.

However, the agency warned that a series of major catastrophic events occurring in quick succession could strain capital positions and result in adverse rating consequences.

“Fitch has a ‘neutral’ fundamental sector outlook for the US property/casualty (P&C) insurance sector in 2026, as well as for both commercial and personal lines. Our ‘deteriorating’ outlook for the global reinsurance sector for 2026 reflects that underlying operational and business conditions are likely to worsen overall for reinsurers globally,” Fitch concluded.

Continue Reading

-

FX Daily: Suspected USD/JPY intervention adds to weak dollar moment | articles

Suspected Japanese intervention to sell USD/JPY has come at a weak time for the dollar after last week’s geopolitical fracturing. From what we understand so far, Japanese authorities may have intervened on Friday when USD/JPY pushed above 159 after the Bank of Japan policy meeting. The big kicker, however, was widespread discussion that at the London close at 17:00 GMT on Friday, the Federal Reserve started asking banks in New York about their position sizes in USD/JPY. This was seen as akin to a ‘rate check’, where a central bank might be preparing the market for physical intervention. That the Fed was allegedly doing this and not making clear that this activity was purely on behalf of Japanese authorities – i.e., that the Fed was not acting purely as an ‘agent’ – has led to understandable suggestions that the US might be on the verge of joint intervention with Japan. This is something we discussed in this month’s FX Talking.

The prospect of bilateral Japan-US intervention is understandably a more powerful one than mere passive intervention from Tokyo alone. Why would Washington want to get involved? We see two reasons: a) the weak yen was adding to last week’s JGB sell-off and indirectly driving US Treasury yields higher. If there is any financial instrument more important than the stock market to the White House right now, it is US Treasuries. And b) the strong USD/JPY was potentially unwinding the work of US tariffs on Japan and giving Japanese manufacturers a competitive advantage.

However, this is not a fundamentally driven move. Yen real interest rates are still negative, and the snap Japanese election on 8 February could still see more pressure emerge on JGBs and the yen. And away from the geopolitical risk premium being attached to US assets, the dollar’s fundamental story has not deteriorated. Plus, we suspect this week’s FOMC meeting could prove slightly dollar bullish.

No doubt, Japanese and potentially US authorities, too, like this constructively ambiguous approach to FX intervention. Traders will be bracing for activity at both market opens and closes now. An upside gap in USD/JPY at 155.65 may now prove intraday resistance. But for the dollar sell-off to continue like this, we will probably need to see some poor domestic US news. Away from the FOMC, this will heighten scrutiny on earnings releases from US Big Tech this Wednesday and Thursday.

This yen intervention story has weighed heavily on DXY, where the prospect of up to $100bn of sales (that’s what Tokyo sold in summer 2024) has caught the dollar at a weak moment. DXY has an upside gap to 97.42 (now resistance) and has a bias to last year’s lows at 96.20/35 – but really needs some fundamental backing for these moves to sustain.

Chris Turner

Continue Reading

-

CVC acquires leading US credit manager Marathon Asset Management (“Marathon”)

Bruce Richards, Co-Founder of Marathon, said: “For 28 years, Marathon’s unwavering mission is to deliver exceptional investment performance for clients through our robust origination platform, rigorous investment approach, deep specialization, and disciplined risk-management. CVC’s focus on delivering exceptional investment returns, integrity, collaboration, and client partnership closely aligns with Marathon’s culture. CVC’s global reach and its investment insights across multiple asset classes and geographies will deliver a powerful partnership, and we greatly look forward to growing our world class credit platform together with CVC.”

The $1.2 billion closing consideration comprises $400 million in cash and up to $800 million in CVC equity2. The transaction also includes earn-out consideration linked to Marathon’s future financial performance over the period from FY2027 to FY2029, of up to $200 million in cash and $200 million in CVC equity2.

The acquisition is expected to be EPS neutral in 2027 and EPS accretive from 2028 onwards, before any revenue or cost synergies.

Bruce Richards and Lou Hanover will continue to co-head the Marathon credit strategies, and Marathon will be re-branded CVC-Marathon.

Bruce Richards will join the Partner Board of CVC, and alongside Andrew Davies, will be responsible for managing the combined CVC Credit business.

The transaction is subject to regulatory and other consents and is expected to close in Q3 2026. Advisers to CVC included JP Morgan, Freshfields, Fried Frank and Ernst & Young. Advisers to Marathon included Sidley Austin.

Transaction details

CVC will acquire 100% of Marathon in a cash and equity transaction with a base consideration valued at up to $1.2 billion, comprising consideration at closing of $400 million in cash and up to 45 million units of equity to be issued by a wholly-owned subsidiary of CVC (“SubCo Units”), exchangeable on a one-for-one basis into CVC ordinary shares, subject to customary completion accounts adjustments and, in respect of 11 million SubCo Units, FY 2027 Marathon financial performance adjustments.

The transaction also includes earn-out consideration linked to Marathon’s future financial performance over the period from FY 2027 to FY 2029, of up to $200 million of cash and 11 million SubCo Units. The earn-out consideration is only payable to Marathon’s partners and employees, increasing long-term alignment and continuity across a broader group. Marathon’s minority partner will receive $280 million of the cash consideration portion of the transaction for 100% of their interest in Marathon.

CVC ordinary shares issued in exchange for any SubCo Units will be held subject to substantially the same lock-up restrictions entered into by CVC’s current and former employees (and permitted transferees) as part of CVC’s IPO in April 2024. The cash portion of the transaction will be funded from CVC’s current cash on balance sheet and undrawn credit facilities.

1 As at 30 September 2025.

2 The CVC equity will be issued by a wholly-owned CVC subsidiary and will be exchangeable on a one-for-one basis into CVC ordinary shares.

Continue Reading

-

Canon’s sustainability efforts recognized with top 1% Platinum rating from global sustainability ratings organization EcoVadis for second consecutive year

Canon’s sustainability efforts recognized with top 1% Platinum rating from global sustainability ratings organization EcoVadis for second consecutive year

TOKYO, January 26, 2026—Canon Inc. announced today that the company has been awarded the Platinum rating for the second consecutive year for its sustainability efforts by France-based global sustainability ratings organization EcoVadis. The award places Canon within the top 1% of companies assessed globally.

EcoVadis assesses over 150,000 companies spanning 185 countries and 250 industries according to various criteria across the four themes of “Environment,” “Labor & Human Rights,” “Ethics” and “Sustainable Procurement.” As worldwide interest in corporate sustainability efforts increases, companies around the world now take into consideration the EcoVadis rating of potential clients and partners.

The Canon Group has made continued efforts toward sustainability, which led to high rankings in all four categories. Canon received particularly high marks in the categories of “Environment” and “Labor & Human Rights” which helped it to obtain the Platinum rating for a second consecutive year.

Canon’s initiatives for sustainability

Canon is working to strengthen initiatives related to environmental and societal issues in order to contribute to societal sustainability.

In the environmental field, Canon aims to achieve net-zero greenhouse gas (GHG) emissions throughout entire product life cycles (Scope 1, 2, and 3) by 2050.1 Canon has also set science-based GHG emissions reduction targets in line with SBTi standards: by 2030, a 42% reduction in Scope 1 and 2 emissions and a 25% reduction in Scope 3 emissions (Category 1 and 11) compared to 2022 levels.2

Furthermore, Canon respects the human rights of all stakeholders involved in its business activities, including employees and business partners. It has formulated the Canon Group Human Rights Policy as a declaration of its stance on human rights and implements human rights due diligence throughout the entire Group while carrying out activities to spread awareness among Group employees both in Japan and overseas through such methods as e-learning.

- 1

Scope 1: Direct emissions (city gas, LPG, diesel, kerosene, non-energy-related greenhouse gases, etc.); Scope 2: Indirect emissions (electricity, steam, etc.); Scope 3: Emissions in the supply chains. category 1: Purchased goods and services; category 11: Use of products sold.

- 2

The Science Based Targets initiative (SBTi) is a global initiative that encourages companies to set GHG reduction targets based on climate science. It is jointly operated by the UN Global Compact (UNGC), World Resources Institute (WRI), World Wide Fund for Nature (WWF), and the CDP.

Continue Reading

- 1

-

3 Asian Growth Companies With High Insider Ownership And 24% Earnings Growth

As global markets navigate a period of volatility and geopolitical uncertainty, the Asian market continues to present intriguing opportunities for investors, particularly in the realm of growth companies with high insider ownership. In this environment, stocks that demonstrate robust earnings growth and strong insider commitment can offer a compelling mix of potential stability and upside, making them noteworthy considerations for those looking to understand current trends in Asia’s evolving economic landscape.

Name

Insider Ownership

Earnings Growth

UTI (KOSDAQ:A179900)

24.7%

120.7%

Streamax Technology (SZSE:002970)

32.5%

31.5%

Phison Electronics (TPEX:8299)

10.8%

31.7%

Novoray (SHSE:688300)

23.6%

31.4%

Modetour Network (KOSDAQ:A080160)

12.7%

41.8%

Loadstar Capital K.K (TSE:3482)

31%

23.6%

Laopu Gold (SEHK:6181)

34.8%

34.1%

Gold Circuit Electronics (TWSE:2368)

31.4%

37.5%

FUNDINNOInc (TSE:462A)

33.4%

41.5%

Fulin Precision (SZSE:300432)

10.6%

63.7%

Click here to see the full list of 599 stocks from our Fast Growing Asian Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MIXUE Group operates in the production and sale of fruit drinks, tea drinks, ice cream, and coffee products across Mainland China and internationally, with a market cap of HK$163.39 billion.

Operations: The company’s revenue segments include Franchise and Related Services generating CN¥707.31 million, Sales of Goods contributing CN¥27.37 billion, and Sales of Equipment accounting for CN¥949.98 million.

Insider Ownership: 28.8%

Earnings Growth Forecast: 14.2% p.a.

Mixue Group, a rapidly expanding entity with substantial insider ownership, is poised for growth with earnings projected to rise by 14.2% annually, outpacing the Hong Kong market. Despite not having significant insider trading activity recently, Mixue’s strategic expansion into the Americas signifies its commitment to global growth. The company opened its first U.S. store in Los Angeles and plans further expansion across New York, leveraging a robust supply chain and value-driven menu to capture international markets effectively.

SEHK:2097 Ownership Breakdown as at Jan 2026 Simply Wall St Growth Rating: ★★★★★☆

Overview: Sieyuan Electric Co., Ltd. specializes in the research, development, production, sale, and service of power transmission and distribution equipment both in China and internationally, with a market cap of CN¥147.46 billion.

Continue Reading

-

Amanat Holdings PJSC And 2 Other Undiscovered Gems In The Middle East

The Middle East markets have recently experienced fluctuations, with UAE indices dipping due to renewed geopolitical tensions, even as Dubai’s market had previously reached a near 20-year high. Amidst this backdrop of volatility and opportunity, identifying stocks that show resilience and potential for growth is crucial for investors looking to navigate these dynamic conditions.

Name

Debt To Equity

Revenue Growth

Earnings Growth

Health Rating

Nofoth Food Products

NA

21.36%

25.28%

★★★★★★

Sure Global Tech

NA

10.11%

15.42%

★★★★★★

Payton Industries

NA

3.44%

14.24%

★★★★★★

Analyst I.M.S. Investment Management Services

NA

31.20%

44.24%

★★★★★★

Najran Cement

14.49%

-4.20%

-30.16%

★★★★★★

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi

NA

54.80%

42.62%

★★★★★☆

Gür-Sel Turizm Tasimacilik ve Servis Ticaret

4.69%

36.04%

53.41%

★★★★★☆

Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi

1.30%

7.24%

65.07%

★★★★☆☆

Ajman Bank PJSC

53.89%

16.11%

18.02%

★★★★☆☆

Bosch Fren Sistemleri Sanayi ve Ticaret

36.11%

41.59%

7.72%

★★★★☆☆

Click here to see the full list of 185 stocks from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Value Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, along with its subsidiaries, focuses on investing in education and healthcare companies both within the United Arab Emirates and internationally, with a market capitalization of AED3.23 billion.

Operations: Amanat Holdings derives its revenue primarily from investments in the education and healthcare sectors, generating AED495.94 million and AED380.40 million, respectively. The company’s net profit margin is a key indicator to consider when evaluating its financial performance.

Amanat Holdings PJSC, a relatively compact player in its field, has shown impressive earnings growth of 330% over the past year, significantly outpacing the Diversified Financial industry average of 16%. Despite this surge, a large one-off gain of AED 68.3M has influenced recent financial results. The company boasts more cash than total debt and maintains interest coverage comfortably. Its price-to-earnings ratio stands at 15.3x, slightly below the industry average of 15.6x, suggesting potential value for investors. However, Amanat’s debt to equity ratio rose from 2.8% to 10.9% over five years, indicating increased leverage concerns amidst its profitability streaks.

Continue Reading